massachusetts real estate tax rates

Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value. Massachusetts has 14 counties with median property taxes ranging from a high of 435600 in Middlesex County to a low of 238600 in Berkshire County.

Low Property Taxes Top High School Make Franklin Stand Out 02038 Real Estate

Tax amount varies by county.

. Current Property Tax Rates. Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the highest property tax rate in Massachusetts with a tax rate of 2464. 370 rows Massachusetts Property Tax Rates by Town.

Local Options Adopted by Cities and Towns. Click here for a map with additional tax rate information. Learn all about Marlborough real estate tax.

For example if your home is valued at 500000 your annual property tax bill would be 12170. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. A state excise tax.

Massachusetts Property Tax Rates. Whether you are already a resident or just considering moving to Marlborough to live or invest in real estate estimate local property tax rates and. A local option for cities or towns.

Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor. Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate. This means that if your estate is worth 25 million the tax will apply to the entire 25 million not just the 15 million amount that is above the exemption.

Massachusetts Property and Excise Taxes. Rate Threshold 0 40000. 351 rows 2022 Massachusetts Property Tax Rates.

Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the exemption threshold. The states average effective tax rate is slightly above the national average at 121. Tax rates in Massachusetts are determined by cities and towns.

Of that 167 billion or 216 of the total revenue collected is from property taxes. A state sales tax. The Senior Circuit Breaker tax credit is based on the actual.

If you are age 65 or older you may be eligible to claim a refundable credit on your personal state income tax return. If youre responsible for the estate of someone who died you may need to file an estate tax return. An owners property tax is based on the assessment which is the full and fair cash value of the.

Under Massachusetts law the government of your city public schools and thousands of other special purpose districts are given authority to evaluate real estate market value set tax rates. Real estate taxes in Massachusetts are the seventh highest in the entire US. The graduated tax rates are capped at 16.

They are expressed in dollars per 1000 of assessed value often referred to as mill. Property tax is an assessment on the ownership of real and personal property. If the total tax on real estate is over 3000 the tax must be paid by the date due in order to maintain the right to appeal an abatement decision.

Counties in Massachusetts collect an average. The citys tax rate is 2434 per 1000 of assessed value for fiscal year 2019. Massachusetts Estate Tax Rates.

This report includes all local options except meals rooms short-term rentals and recreational. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. 6th highest of 50.

The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. Adopted Local Options Impacting Property Tax.

Moved South But Still Taxed Up North

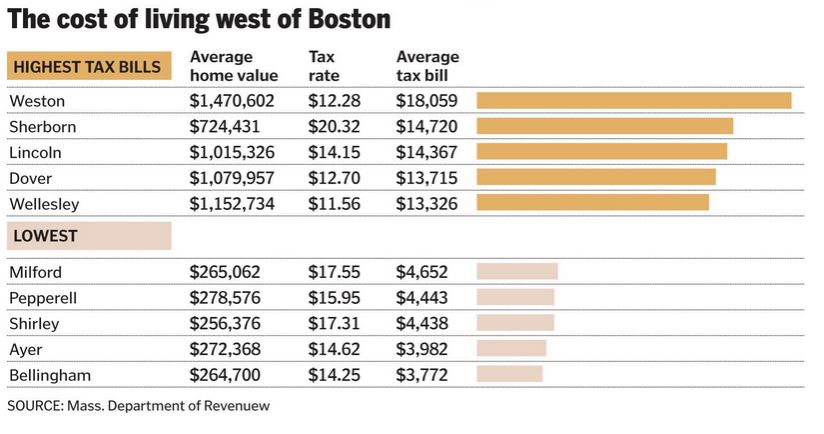

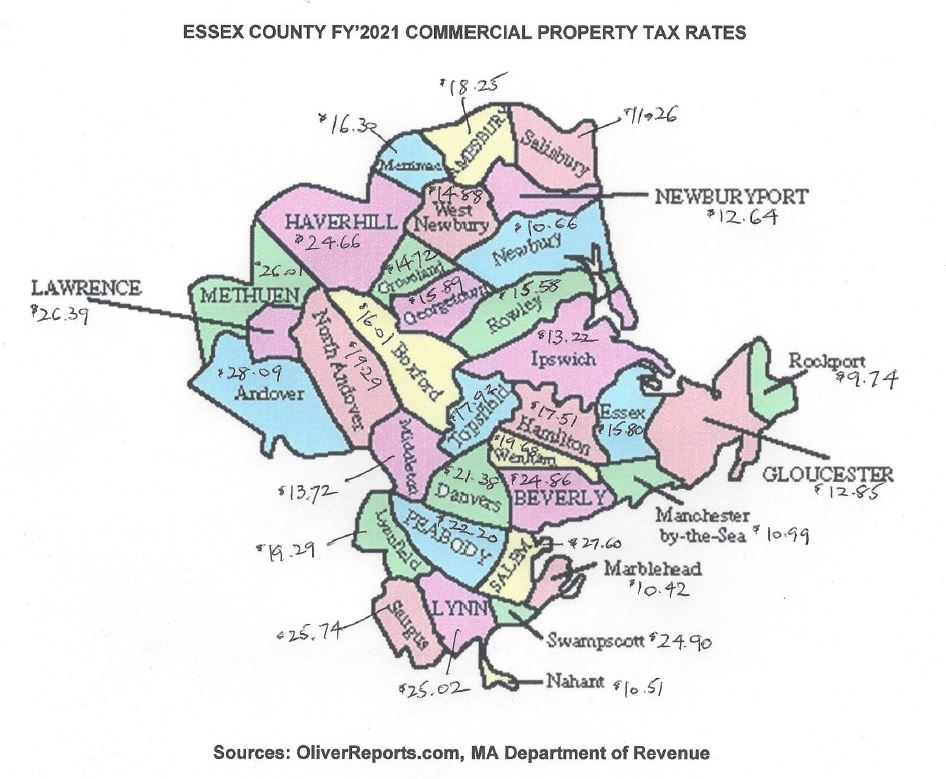

Essex County 2021 Commercial Property Tax Rates Town By Town Guide Oliver Reports Massachusetts

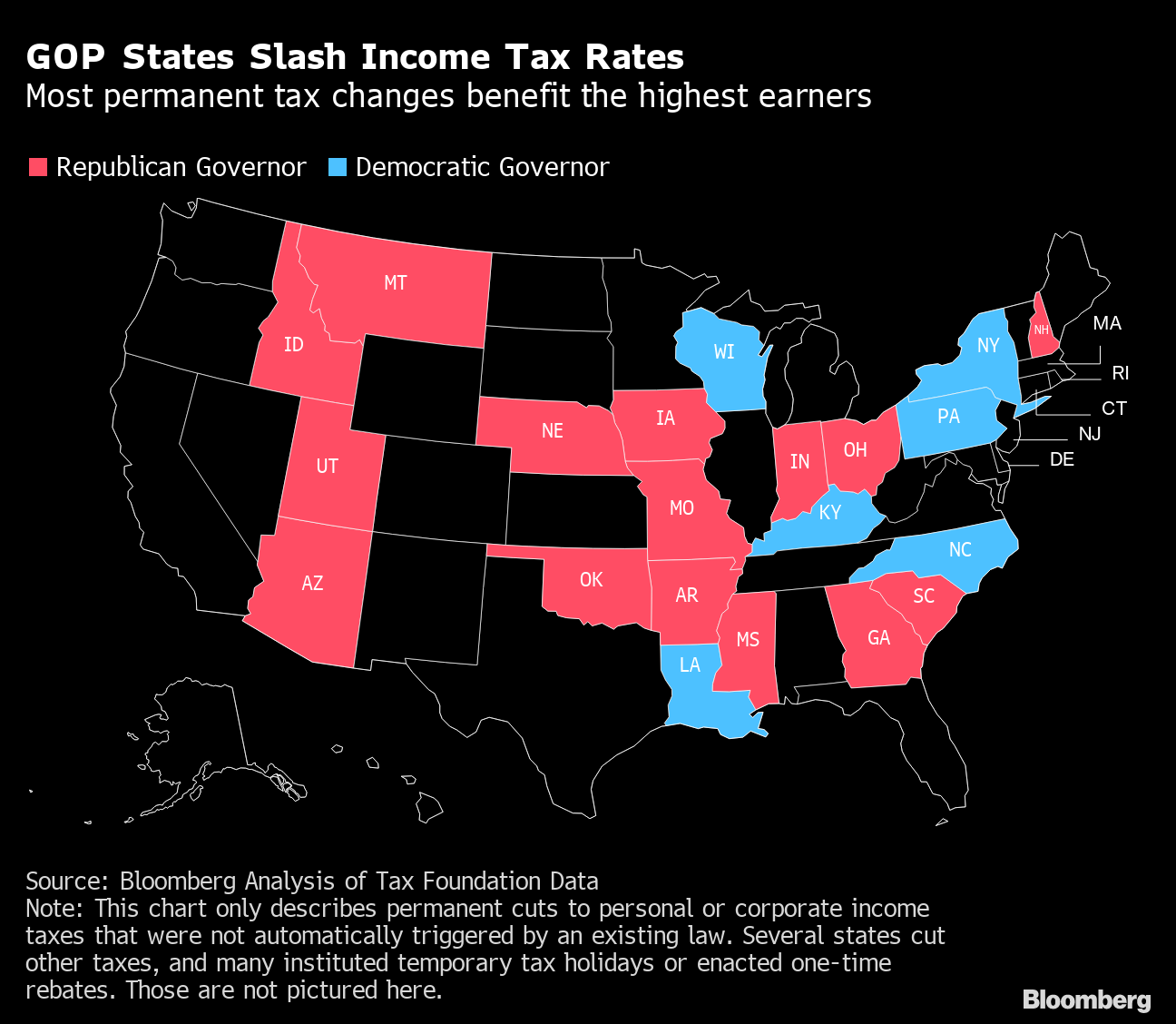

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

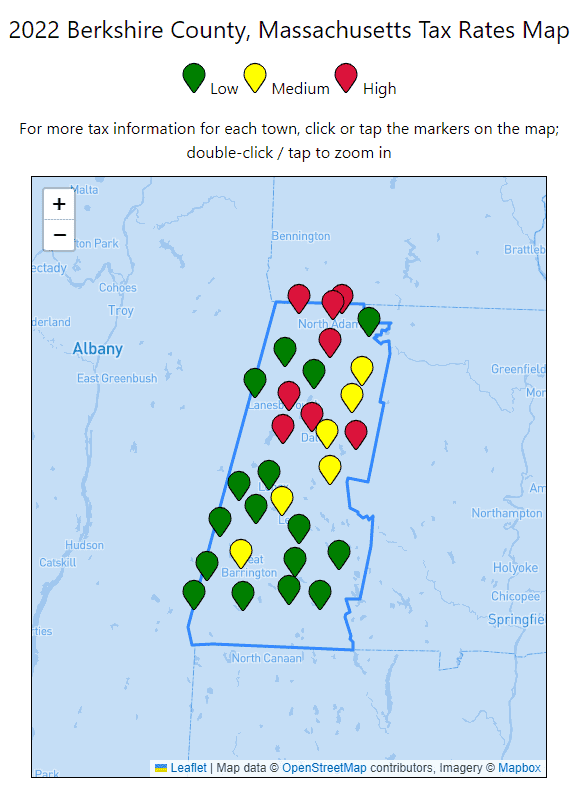

2022 Berkshire County Massachusetts Property Tax Rates Map Includes Pittsfield North Adams Adams Williamstown Etc

Boston S Tax Rates Set For Fy21 Boston Municipal Research Bureau

Massachusetts Property Taxes By County 2022

Property Taxes By County Interactive Map Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Taxes Rates By Cape Cod Town Cape Cod Chamber Of Commerce Cape Cod Ma

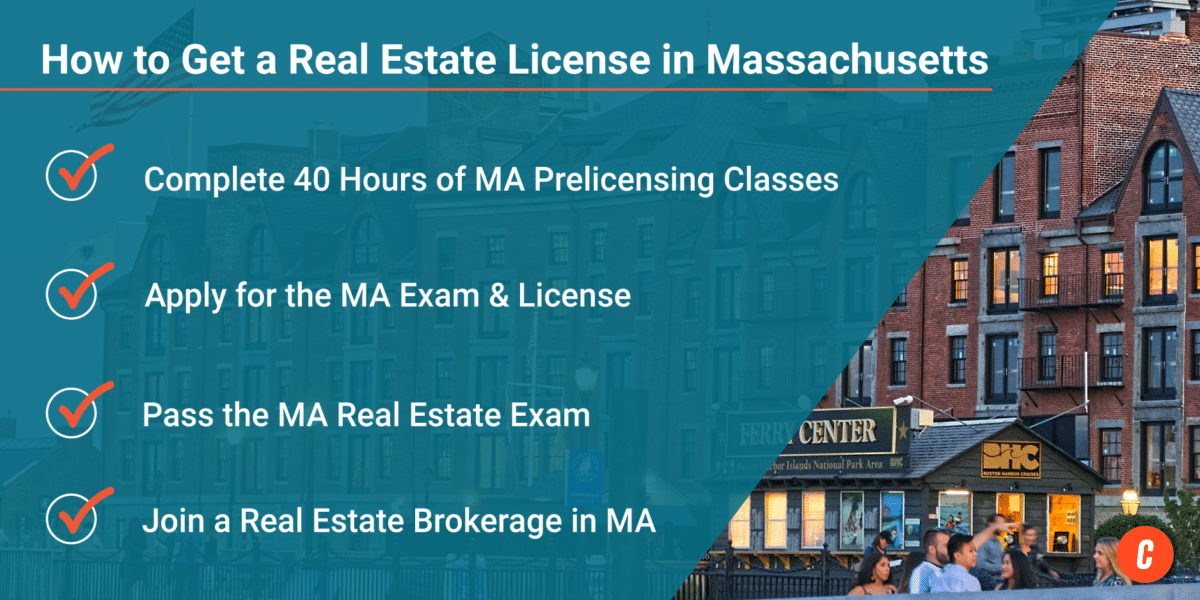

How To Get A Real Estate License In Massachusetts The Close

Massachusetts Sales Tax Rate Rates Calculator Avalara

What You Need To Know About Property Taxes In Massachusetts Buying News Boston Com Real Estate

Riverside County Ca Property Tax Calculator Smartasset

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Disabled Veteran Property Tax Exemptions By State And Disability Rating

How Do State And Local Property Taxes Work Tax Policy Center

Treasurer Collector Town Of Montague Ma

2022 Residential Commercial Property Tax Rates Ma Cities Towns Across Massachusetts Ma Patch